The retail division of the insurer has set up a telematics product available to brokers via its Masterquote platform.

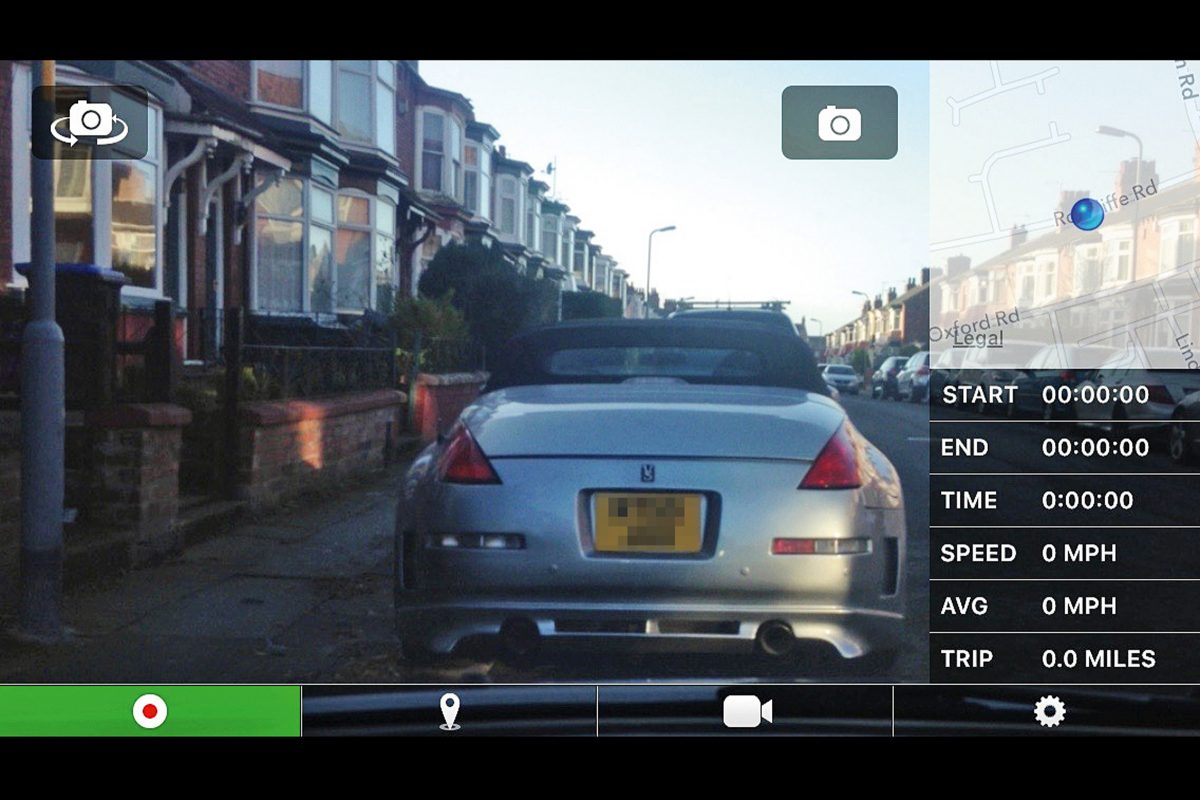

Markerstudy Retail is launching a new product which it says combines dash cam footage with telematics to offer motor policy holders a competitive rate and protect drivers against fraudulent claims.

Markerstudy said the product uses an “award winning Internet of things (IoT) platform”. The product is aimed at inexperienced lower mileage drivers living in cities, who are looking for cover that may provide peace of mind against crash for cash claims.

According to the insurer the policy, underwritten by Zenith Insurance, provides a combined camera and telematics device supplied by VisionTrack. The device is fitted behind the rear view mirror by a qualified engineer, who visits the customer within seven days of buying cover.

Liability

Ross Barrington, managing director of retail, commented: “In today’s market the use of telematics and camera footage is becoming more and more vital in confirming liability.

“We believe that this new product will be extremely helpful to drivers in higher risk built up areas, such as London or Manchester, who might otherwise struggle to find affordable cover.”

Markerstudy claimed that the VisionTrack technology has already saved it significant money this year in cases where its footage has successfully proved liability in the insurer’s favour.

Simon Marsh, managing director of VisionTrack added: “I firmly believe that the combination of telematics and visual footage are key to encouraging better driver behaviour.

“The benefits that video telematics can offer the insurer and clients are huge against fraudulent and exaggerated claims, whilst also improving road safety. Video helps insurers and brokers engage with the customer, showing them how they drive in the real world.”